If you’re looking for a credit card with no annual fee, solid rewards, and tools to manage your credit, Discover offers several options worth your attention.

Each card is built around a specific goal—earning cashback, building credit, or financing purchases with a low introductory APR.

Key Features You’ll Find Across Discover Credit Cards

Start by understanding the core benefits shared across Discover’s card lineup. These features are designed to support everyday spending and responsible credit use.

- $0 Annual Fees on all card options

- Cashback Match in the first year—Discover automatically doubles the rewards you earn

- U.S.-Based Customer Service that’s available 24/7

- Freeze it® Tool to instantly freeze your card via mobile app

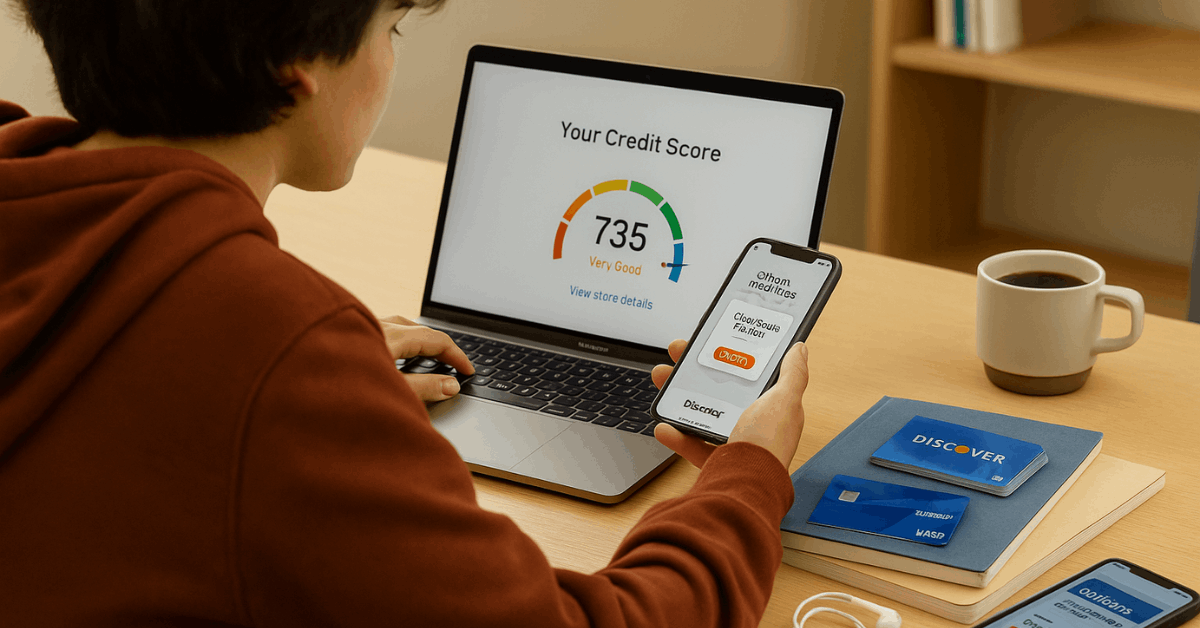

- Free Monthly FICO® Score Access

- Secure Mobile App for account management and reward redemption

- Flexible Redemption Options like statement credits, PayPal checkout, or gift cards

Cashback Rewards Program

Discover’s cashback credit cards are simple and rewarding. You earn more on categories that matter and still get 1% on other purchases.

Discover it® Cash Back

This card works best if you want to maximize your everyday spending.

- 5% cashback on rotating quarterly categories (after activation, on up to $1,500 per quarter)

- 1% unlimited cashback on all other purchases

- Cashback Match at the end of your first year

- $0 annual fee

- 0% intro APR on purchases and balance transfers for 15 months

Discover it® Chrome

Prefer simpler categories? This one rewards common purchases without needing to activate categories.

- 2% cashback at gas stations and restaurants (up to $1,000 combined per quarter)

- 1% cashback on all other purchases

- Cashback Match in the first year

- $0 annual fee

Options for Students: Start Building Credit Early

Discover offers cards designed specifically for students. These provide strong rewards and education tools without requiring prior credit history.

Discover it® Student Cash Back:

- 5% cashback on rotating categories (after activation, up to $1,500 per quarter)

- 1% cashback on all other purchases

- $20 Good Grade Reward annually for a GPA of 3.0 or higher (up to 5 years)

- Cashback Match in your first year

- No annual fee and no credit history required

Discover it® Student Chrome:

- 2% cashback at gas stations and restaurants (up to $1,000 per quarter)

- 1% on all other purchases

- Includes the Good Grade Reward

- Cashback Match in the first year

- Designed for students who want a low-maintenance rewards card

Rebuild Credit with the Discover it® Secured Credit Card

If you’re rebuilding or starting from scratch, Discover’s secured card helps you build credit responsibly.

- Requires a refundable security deposit (minimum $200)

- Reports to all three credit bureaus

- 2% cashback at gas stations and restaurants (on up to $1,000 quarterly)

- 1% cashback on all other purchases

- Free access to your FICO® score

- Cashback Match for new cardholders

- $0 annual fee

After seven months, Discover will review your account for eligibility to upgrade to an unsecured card and return your deposit.

Travel Benefits: Discover it® Miles

If you travel frequently, this card earns flexible miles instead of cashback.

- 1.5x miles per dollar on all purchases

- Miles never expire

- Redeem miles for travel or as statement credit

- 0% intro APR for 15 months on purchases

- $0 annual fee

- No foreign transaction fees

Interest Rates and Fees Overview

Here’s a breakdown of typical rates and fees. These numbers vary based on your credit score and card type.

| Card Type | Intro APR | Ongoing APR | Annual Fee | Foreign Transaction Fee |

| Discover it® Cash Back | 0% for 15 months | 17.24%–28.24% variable | $0 | $0 |

| Discover it® Student | 0% for 6 months | 18.24%–27.24% variable | $0 | $0 |

| Discover it® Secured | None | 28.24% variable | $0 | $0 |

| Discover it® Miles | 0% for 15 months | 17.24%–28.24% variable | $0 | $0 |

Other fees to keep in mind:

- Late Payment Fee: Up to $41 (first fee waived)

- Balance Transfer Fee: 3% introductory; up to 5% later

- Cash Advance Fee: $10 or 5%, whichever is greater

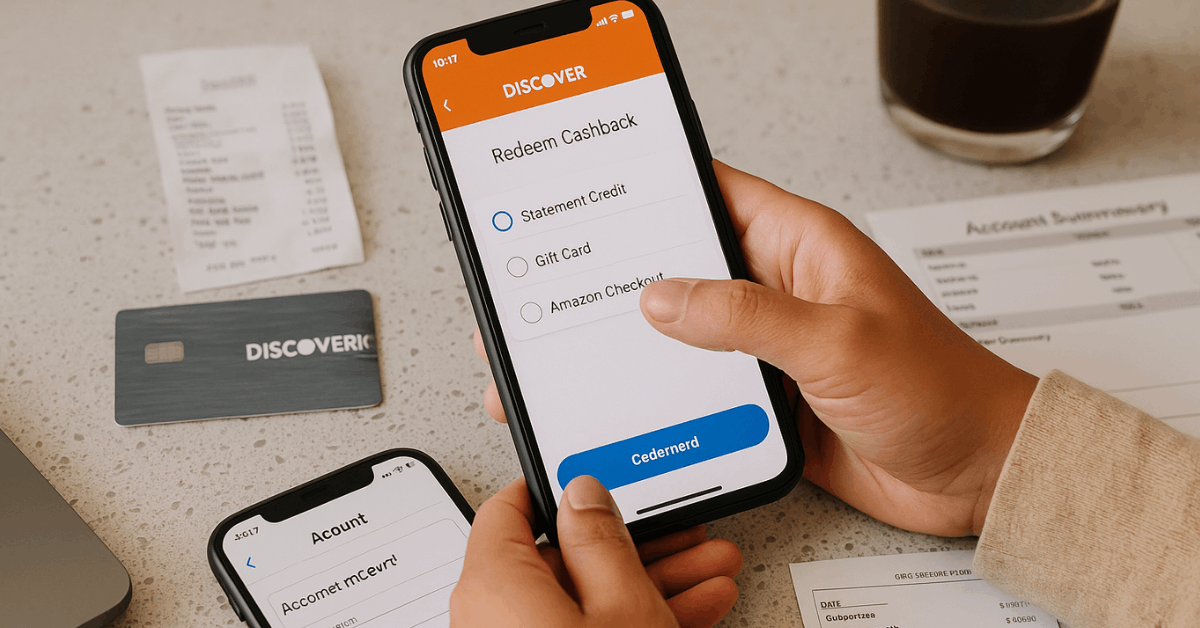

How to Redeem Cashback or Miles

Your rewards don’t sit idle. Discover offers several flexible redemption options:

- Statement Credit: Apply cashback directly to your card balance

- Direct Deposit: Transfer to your checking or savings account

- Amazon and PayPal: Use cashback at checkout

- Gift Cards: Redeem for cards that often have bonus value

- No Minimum Redemption: Redeem any amount at any time

Discover Card Application Process

Getting started is simple. Discover has a user-friendly application that can be completed online in minutes.

Step-by-Step Guide:

- Check Pre-Approval: Use Discover’s online tool to see if you qualify without affecting your credit score.

- Choose a Card: Select the card that best suits your needs—cash back, student, secured, or travel.

- Fill Out Your Application: Provide personal details, including your income and employment status.

- Submit and Wait for Approval: Most applicants receive an instant decision. If approved, your card arrives in 5–7 business days.

Managing Your Account

Once your card is active, you can manage everything through Discover’s digital tools:

- Website Access: Log in at discover.com

- Mobile App: Download for iOS or Android

- Features: Freeze your card, track your FICO® score, make payments, and redeem rewards

Who Should Get a Discover Card?

These cards are a great fit if you fall into any of these groups:

- Students: No credit history needed, plus education tools and cashback

- First-Time Cardholders: Easy to manage, no hidden fees, and strong support

- Cashback Seekers: Competitive rewards, no annual fee, and flexible redemption

- Travelers: No foreign transaction fees and 1.5x miles with Discover it® Miles

Discover Card Support and Contact Details

If you need help, Discover makes it easy to reach their U.S.-based team.

- Customer Service (24/7): 1-800-DISCOVER (1-800-347-2683)

- International Support: +1-224-888-7777

- Relay Service: Dial 711 for hearing/speech support

- Mailing Address: Discover Financial Services, P.O. Box 30943, Salt Lake City, UT 84130

Pre-Approval and Login Tools

Discover offers an online pre-approval tool so you can avoid unnecessary credit inquiries.

You can also log in to manage your account, view transactions, and access your credit score—all in one place.

Disclaimer: This article is for informational purposes only. Terms and conditions are subject to change. Always check Discover’s official site for the most current offers before applying.

Conclusion

Discover credit cards offer a flexible mix of rewards, no annual fees, and tools that support smart credit management. Whether you’re a student, a first-time cardholder, a cashback enthusiast, or someone rebuilding credit, there’s a Discover card that fits your goals.

Just choose the one that aligns with your lifestyle and take full advantage of the features to get the most value.