Petal credit cards offer a streamlined way to improve your credit profile without incurring unnecessary charges. The information below explains every key detail, ensuring you can quickly decide which Petal card fits your financial goals.

Petal at a Glance

Petal issues Visa cards through WebBank, helping consumers everywhere focus on credit growth instead of fees.

- Each account reports monthly to Equifax, Experian, and TransUnion, creating a verifiable repayment history across the three major bureaus.

- Real‑time income analysis during application allows newcomers and thin‑file users to qualify without an established score.

- Mobile‑first tools simplify spending, rewards tracking, and security management in any location.

Comparing All Petal Card Variants

A three‑tier lineup lets you match benefits to credit experience.

Petal 1 — Entry‑Level Flexibility

Petal 1 targets individuals with limited history who need a fee‑free starting point.

- Annual fee: $0.

- Variable APR: 28.99 % – 33.99 %, depending on credit factors.

- Credit limit range: $300 – $5,000 after approval.

- Rewards: 2 % – 10 % cashback at participating merchants through Petal Offers.

- Ideal for: First‑time cardholders seeking a low‑risk path toward stronger scores.

Petal 1 Rise — Easier Approval, One Fixed Charge

Petal 1 Rise provides the same merchant cashback while accepting very thin credit files.

- Annual fee: $59, the only recurring cost in the lineup.

- Variable APR: 28.99 % – 33.99 %.

- Approval focus: Real‑time bank data outweighs traditional FICO requirements, increasing access in the United States.

- Rewards: 2 % – 10 % at select merchants identical to Petal 1.

- Ideal for: Users rebuilding scores who need an extra approval boost and can absorb a modest yearly fee.

Petal 2 — No‑Fee Rewards on Every Purchase

Petal 2 removes most common card expenses while expanding cashback coverage.

- Annual fee, late fee, foreign fee: $0 across the board.

- Variable APR: 28.99 % – 30.99 %, generally lower than the Petal 1 range.

- Credit limit range: $300 – $10,000, reflecting improved borrower profiles.

- Rewards:

- 1 % from day one on all spending.

- 1.25 % after six consecutive on‑time payments.

- 1.5 % after twelve on‑time payments.

- 2 % – 10 % at participating Petal Offers merchants.

- Ideal for: Responsible spenders chasing broad cashback while eliminating penalty charges.

Core Benefits That Drive Value

Petal cards share several traits designed to help you build lasting financial strength.

Transparent Fee Structure

A clear pricing model keeps budgeting straightforward.

- Petal 2 removes virtually every standard credit‑card charge, including global transaction fees—an advantage for travelers and online shoppers in United States.

- Petal 1 keeps costs minimal with a $0 annual fee, while Petal 1 Rise requires only one predictable $59 payment per year.

Cashback That Grows With Good Habits

Rewards encourage disciplined usage instead of complex category juggling.

- Merchant‑based offers on Petal 1 variants deliver higher percentages at grocery chains, gas stations, and popular online stores.

- A flat‑rate ladder on Petal 2 boosts returns automatically after consistent on‑time payments, linking discipline to tangible savings.

Automatic Credit‑Limit Reviews

Every few months, Petal’s proprietary Leap program evaluates payment history and income changes. Responsible activity can unlock higher limits, lowering utilization and improving your score.

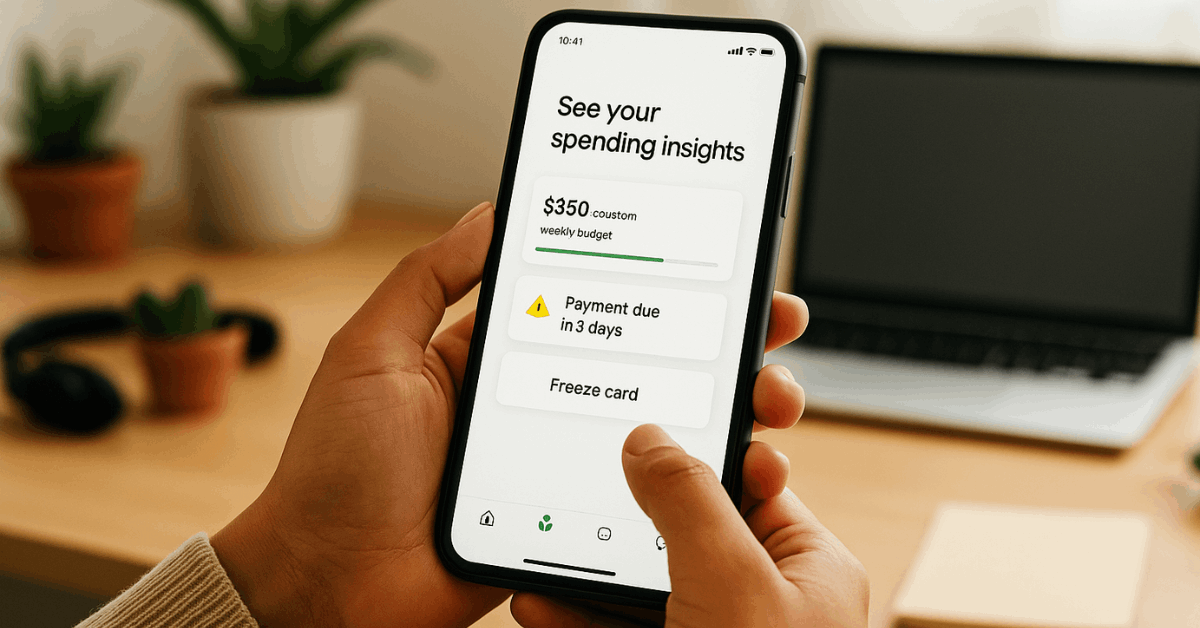

Digital Convenience and Security

The Petal mobile app places control at your fingertips.

- Link cards to Apple Pay or Google Pay for seamless tap‑to‑pay transactions.

- Freeze or unfreeze instantly if the card is misplaced.

- Monitor real‑time spending analytics that flag unusual activity before issues escalate.

Eligibility and Application Steps

Qualifying remains straightforward, even for newcomers outside the mainstream credit system.

Minimum Requirements

Applicants must be at least eighteen, possess a valid SSN or ITIN, and show a U.S. residential address; however, the usage guidance applies in the United States.

Bankruptcy within the past forty‑eight months or previous Petal ownership disqualifies applicants.

Step‑by‑Step Online Process

- Navigate to Petal’s official website and choose Check Your Offer.

- Enter basic identity details that trigger a soft credit inquiry, preserving your current score.

- Link a checking or savings account securely to share income inflows and expense patterns—this data often outweighs a thin credit file.

- Review the potential offer (Petal 1, Petal 1 Rise, or Petal 2) plus the projected APR and limit.

- Submit final consent to convert the offer into a formal application, which produces a hard inquiry only at that point.

- Receive a decision within minutes; physical cards ship promptly while digital credentials activate inside the app.

A concise approach reduces paperwork and delivers faster answers than many traditional issuers in the United States.

Boosting Approval Likelihood

Responsible financial habits can tilt the odds in your favor.

- Maintain positive balances in linked accounts over several months, proving reliable cash flow.

- Pay utilities, streaming services, or student loans on schedule to demonstrate consistency, even if those vendors do not report to bureaus.

- Reduce outstanding debts relative to income before applying, improving the debt‑to‑income ratio that Petal evaluates.

- Double‑check personal details to prevent mismatches that trigger automatic declines.

Interest Rates and Cost Snapshot

Grasping interest mechanics helps you avoid unnecessary charges.

- Petal 2 APR: 28.99 % – 30.99 % (variable).

- Petal 1 and Petal 1 Rise APR: 28.99 % – 33.99 % (variable).

- All accounts receive at least a twenty‑five‑day grace period on new purchases before interest accrues.

- Paying the statement balance in full each cycle prevents finance charges entirely, allowing you to leverage rewards without cost.

Credit‑Building Support Tools

Petal tailors features to help you strengthen your profile systematically.

- Payment reminders inside the app highlight due dates and minimum amounts, reducing late risks.

- Leap program reviews every six months may raise your limit, lowering utilization.

- Spending insights categorize transactions so you can adjust habits quickly.

- Automatic reporting to all three bureaus ensures that on‑time payments translate into score gains in the United States.

Managing Your Account Online

Continuous oversight keeps finances organized.

- View detailed statements anytime and download them for record‑keeping.

- Set custom transaction alerts to spot double charges or fraud instantly.

- Update address, email, and phone information without calling support.

- Freeze the card in seconds if it is lost, then unfreeze once recovered.

Support Channels

Petal’s service team resolves common issues promptly.

- Phone: 1‑855‑697‑3825, available Monday through Friday, 9 AM – 6 PM EST.

- Email: [email protected] provides written assistance within one business day.

- Mail for payments: Petal, P.O. Box 1150, New York, NY 10008‑1150.

- Mail for documents: Petal Card Inc., MSC – 166931, P.O. Box 105168, Atlanta, GA 30348‑5168.

Most questions, including disputes, limit reviews, or lost‑card requests, resolve faster inside the mobile app.

Who Benefits Most?

Several groups gain particular value from Petal’s flexible approval and transparent pricing.

- College students are learning to manage borrowing decisions responsibly.

- International newcomers who lack a lengthy U.S. history yet maintain healthy bank activity.

- Young professionals are aiming to replace high‑fee starter cards with something cleaner.

- Credit rebuilders recovering from late payments, charge‑offs, or thin files.

- Frequent online shoppers abroad who need a card without foreign transaction fees.

Actionable Tips for Maximizing Petal

Follow these practical guidelines to unlock every advantage.

- Pay the full statement balance each month to avoid interest and qualify for higher cash back on Petal 2.

- Use the card at Petal Offers merchants whenever possible, and capture up to 10% back without extra planning.

- Keep utilization below 30% of the limit; request a higher limit through the Leap program once you’re eligible.

- Turn on push notifications for payments due, large transactions, and foreign usage to stay informed instantly.

- Review the in-app budget categories each quarter and adjust your spending habits before overspending occurs.

Disclaimer: Product details, interest ranges, and eligibility rules can change without notice. Always consult the official Petal website for the latest terms before applying.

Conclusion

Petal credit cards combine fee transparency, scalable rewards, and inclusive underwriting to support consumers in the United States who need a practical path to stronger credit.

Selecting Petal 1, Petal 1 Rise, or Petal 2 depends on your existing profile and reward priorities, yet all three choices revolve around the same principle: disciplined payments translate into measurable credit growth and everyday savings.

Adopt smart repayment habits, leverage digital tools, and watch your financial credibility expand month after month.