When you’re choosing a credit card, two of the most appealing features are balance transfer promotions and attractive cashback rewards.

U.S. Bank offers competitive options that help you manage existing debt efficiently or maximize spending rewards.

This article highlights the top U.S. Bank credit cards, helping you select the best fit based on your financial goals.

Are U.S. Bank Credit Cards a Reliable Option?

U.S. Bank credit cards are consistently regarded as trustworthy and advantageous, particularly for managing debt or earning cashback rewards. These cards feature:

- Competitive Rewards Programs: Robust reward structures suited to various spending habits.

- Low Introductory APR Offers: Extensive periods of 0% introductory APR, ideal for debt consolidation.

- Credit-Building Tools: Secured credit cards available for improving or establishing credit.

- Strong Customer Satisfaction: Generally positive reviews, averaging 3.8 out of 5 stars.

Factors to Keep in Mind

However, keep these factors in mind:

- While U.S. Bank credit cards offer valuable rewards and features, there are a few limitations to consider before applying. Some cards have limited global usability due to foreign transaction fees, which typically add 2–3% to each international purchase.

- If you travel abroad or shop from international retailers often, this can reduce the overall value of your rewards. Additionally, certain cards require extra steps to maximize benefits.

- For example, the Cash+® Visa Signature® Card offers customizable cashback categories, but you must activate your chosen categories every quarter. Forgetting to do so means you’ll miss out on the higher earning rates, so staying on top of these activations is essential to make the most of the card.

Best U.S. Bank Credit Cards for Balance Transfers

Managing high-interest debt becomes simpler with these recommended cards:

1. U.S. Bank Visa® Business Platinum Card

This card is perfect for businesses looking to consolidate and manage substantial debt.

- Intro APR: 0% for 18 billing cycles on balance transfers

- Standard APR: 16.99% – 25.99% (variable)

- Balance Transfer Fee: 3% or minimum $5

- Annual Fee: $0

2. U.S. Bank Shield™ Visa® Credit Card

For an extended interest-free period, this card provides unmatched flexibility.

- Intro APR: 0% for 24 billing cycles on balance transfers

- Standard APR: 17.74% – 28.74% (variable)

- Balance Transfer Fee: 5% or minimum $5

- Annual Fee: $0

Top Cashback U.S. Bank Credit Cards

If cashback rewards are your priority, these cards offer generous returns:

1. U.S. Bank Cash+ Visa Signature Card

Customize rewards to align with your spending habits.

- Rewards Structure:

- 5% cashback on two categories (up to $2,000 quarterly)

- 2% cashback on one everyday category (gas, groceries, etc.)

- 1% cashback on other purchases

- Intro APR: 0% for 15 billing cycles

- Standard APR: 18.49% – 28.74%

- Annual Fee: $0

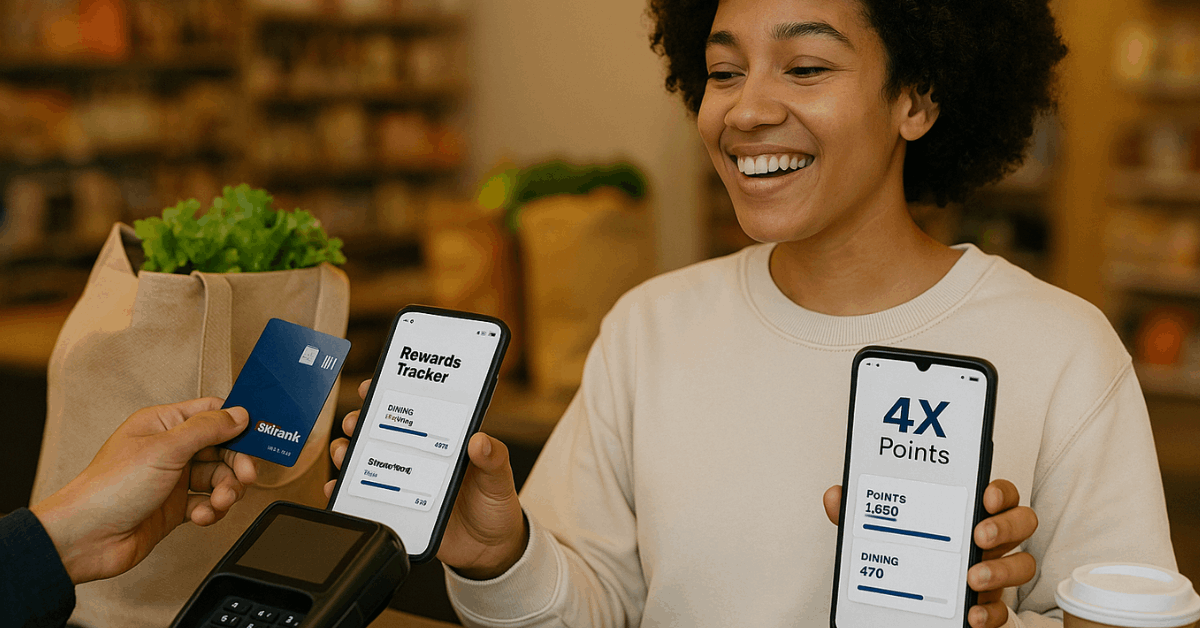

2. U.S. Bank Altitude® Go Visa Signature® Card

Excellent for individuals who frequently spend on dining and groceries.

- Rewards Structure:

- 4X points on dining, takeout, and delivery

- 2X points at grocery stores, gas stations, and streaming services

- 1X points on all other spending

- Welcome Bonus: 20,000 points after $1,000 spent in first 90 days

- Intro APR: 0% for 15 billing cycles

- Standard APR: 18.24% – 28.24%

- Annual Fee: $0

3. U.S. Bank Smartly Visa Signature Card

Ideal for straightforward cashback without category restrictions.

- Rewards Structure:

- Flat 2% cashback on all purchases

- Up to 4% cashback if linked with U.S. Bank Smartly Checking or Savings accounts

- Intro APR: 0% for 12 billing cycles

- Standard APR: 18.49% – 28.74%

- Annual Fee: $0

4. State Farm U.S. Bank Credit Cards

Best suited for current State Farm customers who regularly pay insurance premiums.

- Rewards Structure:

- 3% cashback on State Farm insurance premium payments

- 2% cashback at gas stations, restaurants, and grocery stores

- 1% cashback on all other purchases

- Annual Fee: $0

How Many U.S. Bank Credit Cards Can You Own?

No fixed limit exists on how many U.S. Bank cards you can hold. However, most customers maintain between two to four cards. The approval process assesses your credit history, income, and relationship with the bank.

Applying for a U.S. Bank Credit Card

To successfully apply, you will need to provide:

Follow these steps to complete your application successfully:

- Step 1: Gather Personal Information: Prepare your full name, home address, date of birth, and Social Security number.

- Step 2: Provide Financial Details: You’ll need to enter your annual income, monthly housing payments, and income source.

- Step 3: Decide on Optional Features: Indicate if you’re interested in a balance transfer or want to add an authorized user.

- Step 4: Submit Your Application: Apply online through the U.S. Bank website or visit a local U.S. Bank branch to complete the process.

- Step 5: Wait for a Decision: Most applicants receive a response within minutes, but some may take longer depending on additional verification.

U.S. Bank Credit Cards Customer Service

For assistance regarding your credit card, contact U.S. Bank through:

- Phone: 800-USBANKS (872-2657)

- Mail: U.S. Bank, 800 Nicollet Mall, Minneapolis, MN 55402

- Mobile App: Available on Android and iOS for convenient account management

Choosing the Right U.S. Bank Credit Card

Selecting the best U.S. Bank credit card depends on how you spend, your financial goals, and whether you want to manage debt, earn rewards, or both.

Start by reviewing your monthly expenses and identifying where you spend the most—such as dining, groceries, travel, or utilities.

Debt Management

If you’re focused on managing debt or reducing interest, the Visa® Business Platinum or Shield Visa® Credit Card are strong options.

They offer extended 0% introductory APR periods on purchases or balance transfers, making them useful for paying off existing balances or financing large purchases without immediate interest.

Cashback Rewards

If you’re looking to maximize cashback rewards, cards like the Cash+® Visa Signature® and Altitude® Go Visa Signature® stand out.

Cash+ allows you to choose your highest-earning categories, giving you more control over your rewards, while Altitude Go offers consistent cashback in everyday areas like dining and streaming.

Both options are great if you want to earn back on the spending you already do.

Final Considerations

U.S. Bank credit cards cater to diverse financial needs, from balance transfers to rewarding everyday purchases.

Evaluate the specifics of each card, including introductory offers, cashback opportunities, and annual fees, to determine the best option aligned with your personal or business finances.

Always consult U.S. Bank’s official resources for the latest terms and conditions before finalizing your choice.